Once repeated for all five years, the “Total Depreciation” line item sums up the depreciation amount for the current year and all previous periods to date. The average remaining useful life for existing PP&E and useful life assumptions by management (or a rough approximation) are necessary variables for projecting new Capex. Therefore, companies using straight-line depreciation will show higher net income and EPS in the initial years.

Depreciation of Long-Term Assets

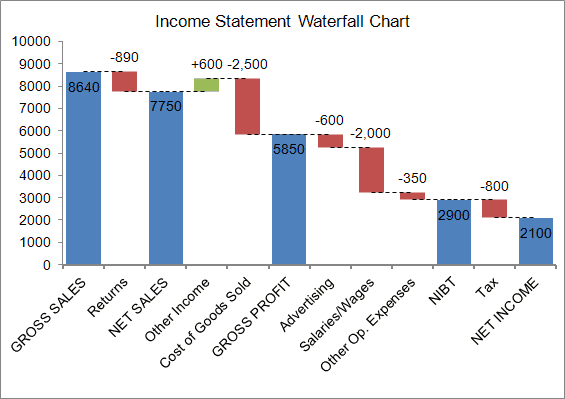

In this approach, since the direction of all the calculations is columnar, it is very easy to expand it by just copy and pasting. To achieve this, it creates a waterfall section where you create a separate row for each of the years in which the capex depreciation waterfall is to be incurred. The waterfall approach looks at the problem on how to spread the cost of an asset of asset over its life and then stop. While the waterfall approach offers a more structured method, it has its drawbacks, as we’ll explore.

Understanding IAS 16: Property, Plant, and Equipment with a Focus on Depreciation Methods

In this blog, we recommend a better approach that is far more simple, scalable, and accurate. BIf we look at the row going right from B, we see a series of years again. This time, though, we can think of the row as containing depreciation in the stated year. The best way to think of this column is to view it as containing purchases in the stated year. Companies issue stock-based compensation to incentivize employees with stock in addition to cash salary.

Waterfall approach and its limitations

In addition, you would also need to add a row for each of the years in the waterfall section and change the formula in the depreciation section. This method is very simple, as long as you ensure that the destination range contains precisely the same number of cells in the column as there are cells in the source row. Liam Bastick highlights some of the more useful functions for financial modelling / Excel spreadsheeting. Liam explains how OFFSET can assist with change your perspective about modelling depreciation… The useful life of an asset is an accounting estimate of the number of years it is likely to remain in service for the purpose of cost-effective revenue generation. The Internal Revenue Service (IRS) employs useful life estimates to determine the amount of time during which an asset can be depreciated.

There’s no need to, say, delete the formula from cells like D7, E8, etc., where the Depreciation Year is before the Capex Year, because the formula already adjusts for this. OR If [Depreciation Year] is less than [Capex Year],Take $0.Here, we’re saying that if the Depreciation Year is more than 6 years after the Capex Year, or if the Depreciation Year is before the Capex Year, no depreciation should be taken. After all, the purchase in this row either hasn’t occurred yet, relative to this Depreciation Year, or it’s already been completely depreciated. In the column going down from E, we have the actual purchases of assets, or capex, that occurs in the year in column A. This cell contains the useful life in years of the asset class that we’re depreciating. But in practice, most companies prefer straight-line depreciation for GAAP reporting purposes because lower depreciation will be recorded in the earlier years of the asset’s useful life than under accelerated depreciation.

- Capex can be forecasted as a percentage of revenue using historical data as a reference point.

- The useful life of an asset is an accounting estimate of the number of years it is likely to remain in service for the purpose of cost-effective revenue generation.

- In a full depreciation schedule, the depreciation for old PP&E and new PP&E would need to be separated and added together.

- While a company’s financial reports—the income statement, the balance sheet, the cash flow statement, and the statement of owners’ equity—represent the company’s financial health and progress, they can’t provide a perfectly accurate picture.

- Aside from the inherited formatting, the main disadvantage here though is that depending upon the nature of the source data and how it is copied, updates in the original data will not flow through to the destination range.

How to Balance the 3-Statement Model

That’s because unlike current assets and liabilities, there’s a likelihood these items could be unrelated to operations such as investment assets, pension assets and liabilities, etc. Based on analyst research and management guidance, we have completed the company’s income statement projections, including revenues, operating expenses, interest expense and taxes – all the way down to the company’s net income. Useful life refers to the mathematically estimated duration of utility placed on a variety of business assets, including buildings, machinery, equipment, vehicles, electronics, and furniture.

But in the absence of such data, the number of assumptions required based on approximations rather than internal company information makes the method ultimately less credible. The recognition of depreciation on the income statement thereby reduces taxable income (EBT), which leads to lower net income (i.e. the “bottom line”). Therefore, $100k in PP&E was purchased at the end of the initial period (Year 0) and the value of the purchased PP&E on the balance sheet decreases by $20k each year until it reaches zero by the end of its useful life (Year 5).

Instead, the cost is placed as an asset onto the balance sheet and that value is steadily reduced over the useful life of the asset. This happens because of the matching principle from GAAP, which says expenses are recorded in the same accounting period as the revenue that is earned as a result of those expenses. While a company’s financial reports—the income statement, the balance sheet, the cash flow statement, and the statement of owners’ equity—represent the company’s financial health and progress, they can’t provide a perfectly accurate picture. The formula to calculate the annual depreciation is the remaining book value of the fixed asset recorded on the balance sheet divided by the useful life assumption.

This cell is styled speckled blue to emphasise that this cell must deliberately remain blank and not be deleted. In this instance, simply highlight the data and copy the range in the usual way (e.g. CTRL + C). Next, simply select the first cell (i.e. the top left hand corner) of the intended range and Paste Special, Transpose (ALT + E + S + E + ENTER).

For a complete depreciation waterfall schedule to be put together, more data from the company would be required to track the PP&E currently in use and the remaining useful life of each. Additionally, management plans for future capex spending and the approximate useful life assumptions for each new purchase are necessary. Companies seldom report depreciation as a separate expense on their income statement.